|

8 June 2015 |

Amendments to the Russian CFC rules and the capital amnesty

Exemption from taxation of CFC’s profit It should be reminded that a CFC is deemed to be a foreign organization (unincorporated entity), which is not a tax resident of the Russian Federation, and which is controlled by Russian tax residents. For the purposes of CFC, control shall be determined in particular by the volume of the participation of controlling entity:

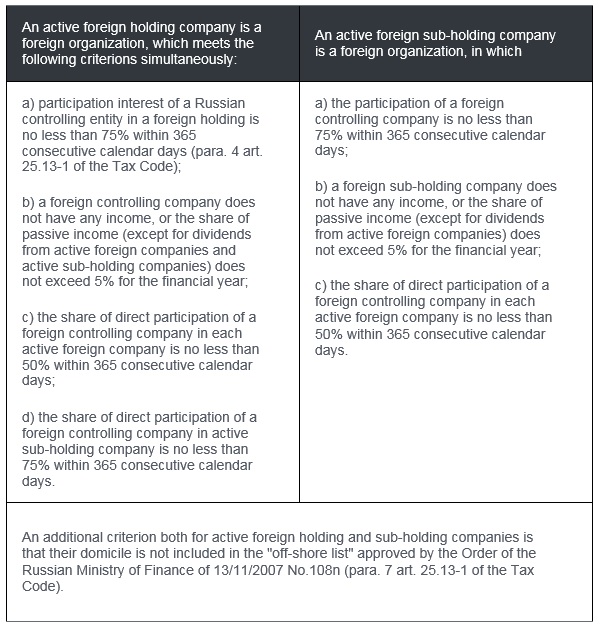

The law introduced amendments extending grounds for CFC's profit to be VAT exempt in the Russian Federation. Such modifications relating to CFC apply retroactively to a legal relationship arisen since January 1, 2015. 1. Owning CFC through public Russian companies (para. 4 art. 25.13 of the Tax Code). The ownership (direct or indirect) of a foreign entity through one or several public Russian companies shall not be recognized as control. As a foreign company is not controlled, the retained earnings are not subject to tax in the Russian Federation according to the rules of CFC. However, the law does not specify the minimum number of public company participants. 2. CFC is either an active foreign company, active controlling, or active sub-holding company (para. 1, para. 8 art. 25.13-1 of the Tax Code). A foreign organization whose share of passive income (dividends, interests, royalty and other types of income stipulated in sub-paras 1-12 para. 4 art. 309.1 of the Tax Code) for the financial year does not exceed 20 % of the total amount of all profit (para. 3 art. 25.13-1 of the Tax Code) shall be recognized as an active foreign company. An active foreign company's domicile must be in a state with which the Russian Federation has entered into an effective agreement for the avoidance of double taxation, and simultaneously such state is not included in the list of states, which do not exchange information, approved by the Russian Federal Tax Service (para. 7 art. 25.13-1 of the Tax Code). No such list has been approved by the time this article was written.

a) such person is not entitled to get (claim) profit (income) of such structure directly or indirectly and exercise control over such structure; b) such person is not entitled to have control over the profits (income) of such structure or its part; c) the assets were irrevocably transferred to this structure. The above criteria will apply only in case the founder (the organizer) of a foreign unincorporated structure does not retain the right to get any of the above rights, including during liquidation of the structure (para. 10 art. 25.13 of the Tax Code). We note that a person other than the founder (organizer) can be recognized as a controlling person if he exercises control over the structure, and if even one of the following conditions is met with regard to it (para. 12 art. 25.13 of the Tax Code): a) such person is actually entitled to receive profits (part thereof) of such structure; b) such person is entitled to dispose of the assets of such structure; c) such person is entitled to receive assets of such structure in case of its winding-up (liquidation, rescission of contract). We also note that foreign legal entities without joint-stock capital are equated by the Law with unincorporated foreign structures (para. 15 art. 25.13 of the Tax Code). Thus, the lawmaker repaired the defect of the previous version of the Tax Code as it pertains to declaring foreign private foundations. Dividends from the Russian organizations The Law introduced a prescription providing that profits in the form of dividends obtained by CFC from Russian organizations are left out when defining CFC's profit (indent 3 para. 1 art. 25.15 of the Tax Code). Whereby it is important that a CFC has an actual right to obtain dividends. The tax implications of voluntary declaration of property and accounts The Law provides warranties to the persons planning to declare their property in accordance with the Federal law of 08/06/2015 No.140-FZ "On voluntary declaration by individuals of property and bank accounts (deposits) and on introduction of modifications into certain legislative acts of the Russian Federation" (further the "Law on voluntary declaration"). Significantly, the exemptions listed in this section are effective with regard to the actions of the declarant and (or) nominal owner of the property taken place before January 1, 2015 (para.13 art.4 of the Law on voluntary declaration). Therefore, the risk of tax control measures with regard to possible violations committed after January 1, 2015 is not avoided. 1. The transfer of property from the nominal owner to the actual one shall not be recognized as sale (sub-para 8.2 para.3 art. 39 of the Tax Code), as well as the receipt by the actual owner of the property form the nominal owner shall not be recognized as income (economic gain), if such property and its nominal owner are mentioned in the special declaration submitted to the tax authority pursuant to the Law on voluntary declaration (para. 2 art. 41 of the Tax Code). 2. In accordance with para. 50 art. 217 of the Tax Code introduced by the Law, the individual taxpayers, who are shareholders, participants, stockholders, founders or controlling persons of a foreign unincorporated structure, are exempt from personal income tax on the income (except for money) obtained during liquidation of a foreign organization (unincorporated structure). In order to apply this exemption, the following conditions must be observed at the same time: a) the taxpayer together with his declaration has provided an application in any format on exemption from taxation of such income and specified the peculiarities of obtained property (proprietary rights) and liquidated foreign organization (unincorporated structure), and attached documents containing information on the value of property at the date of liquidation. b) the procedure of foreign organization (unincorporated structure) liquidation (winding-up) has been completed by January 1, 2017. The law provides for prolongation of this term. 3. The individual taxpayers, who are tax residents of the Russian Federation, are entitled to reduce the income from the sale of property (proprietary rights) obtained during liquidation of a foreign organization (unincorporated structure) by the amount equal to the value of property according to accounting records at the date of liquidation, but not higher that the market value of such property (proprietary rights) (sub-para 2.1. para. 2 art. 220 of the Tax Code). 4. Neither special declaration, nor information contained in it or attached documents can give grounds for a desk-based tax audit (para. 1 art. 88 Tax Code), or on-site tax audit (para. 2 art. 89 of the Tax Code). When considering the materials of tax audit such information cannot be used as evidence (indent 2 para. 4.art. 101 of the Tax Code), and is considered to be a tax secret (para. 8 art. 102 of the Tax Code). 5. The possibility for tax collection shall be excluded from the declarant, if the latter had unpaid (partially paid) taxes on the acquisition, use or disposal of declared property and accounts with regard to possible violations occurred before January 1, 2015 (para. 2.1. art. 45 of the Tax Code). Tax residence of organizations The Law amended provisions of article 246.2 of the Tax Code, which regulate grounds and procedure for recognition of foreign organizations as tax residents of the Russian Federation. The Law excluded criterion for recognition of a foreign organization as a Russian tax resident based on holding most of the board meetings (sub-para 1 para. 2 art. 246.2 of the Tax Code in the previous version). However, the criteria for determining management location connected immediately with the work of executive bodies have been preserved. The Law confirmed the criteria to be met by a foreign organization in order to be recognized as managed from another state. The commercial activity of such foreign organization is carried out with the help of its own qualified personnel and using its assets in the state (in the territory) of its domicile. Whereby a foreign organization provides documented evidence that is satisfies the criteria laid down in this clause (para. 4 art. 246.2 of the Tax Code). Additional criteria for recognition of a foreign organization as a tax resident of the Russian Federation (maintenance of accounting records and management accounting, records management, operative management of personnel) shall be applied in the event the basic criteria of tax residence are satisfied for two or more states (para. 5 art. 246.2 of the Tax Code). The Law made it possible for foreign organizations located in a jurisdiction that has no effective agreement on avoidance of double taxation with the Russian Federation, to declare themselves as Russian tax residents (para. 8 art. 264.2 of the Tax Code). In accordance with introduced amendments, a foreign organization has to provide documents which give grounds for assessment and payment of relevant taxes, to be available at a separate subdivision (indent. 2. para. 8.art. 264.2 of the Tax Code). In the amended version para. 8 art. 264.2 of the Tax Code states that a foreign organization is entitled to recognize itself as a tax resident of the Russian Federation at its own discretion either since January 1 of the calendar year in which the application for recognition as a tax resident was filed, or upon submission of the relevant application with the tax authority at the place of its registration. The provisions of the Law on tax residence are retroactive and apply to legal relations that have arisen since January 1, 2015. |

Related areas

VEGAS LEX_Amendments to the Russian CFC ..and the capital amnesty_06.2015

Download file| File added | 23.09.2015 |

| Presentation | .pdf (1,1 Мб) |